How Jan Dhan Yojana is leading to Lower Inflation and Lesser Alcoholism in India

By October, 2017 300 million bank accounts have been opened in Rural areas with balances totalling USD 10 billion or Rs 67 billion! This financiaL inclusion scheme launched on 28th August, 2014 is the most unique thing ever done in any country. That it has its critics shows the paucity of basic common sense in the Indian opposition and high prevalence of prejudices which trump what is good for the country. By February 2017, 20 million new accounts had opened after the demonetization announcement in October 2017.

How #JanDhan Yojana is leading to Lower Inflation and Lesser Alcoholism in India #JAM Click To Tweet

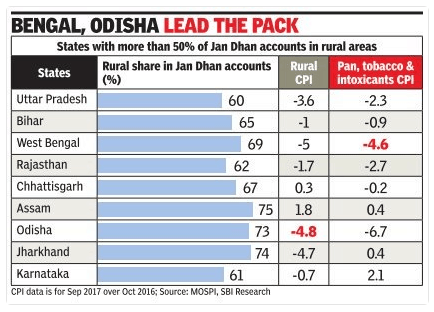

Actually, 75% of the accounts are in just 10 states. UP with 47 million, Bihar with 32 million, and West Bengal 29 million. 60% of all the accounts under Jan Dhan have been opened in rural areas.

Basically, what is known as JAM – the trinity of Jan Dhan-Aadhaar-Mobile has brought about a revolution in the rural areas.

Because of formalization of the economy, inflation in states where more Jan Dhan accounts have been opened – has significantly in statistical terms, come down. Where experts had predicted an increase in inflation, the opposite seems to have happened! The Consumer Price Index (CPI) is 3.28% in September 2017, compared to 4.39% in September 2016!

Not just this, there is another side effect of the increase in Jan Dhan accounts – people have become sober and reduced drinking and use of alcohol. State Bank of India’s Economic Research Wing has found that this drop in use of intoxicants is both “statistically significant and economically meaningful”!

Also since October 2016, there has been a significant increase in household medical expenditure specifically in Bihar, West Bengal , Maharashtra and Rajasthan.

These days there are multinationals which are planning to use the JAM trinity to structure their offerings and businesses in India. DellEMC is one such business.

“We have invested heavily in India with sales and marketing operations but also in research and development. They are doing research and development on server, storage and software products. India is a strategic market for us.” Dell EMC’s India operations is looking to capitalise on the JAM (Jan Dhan-Aadhaar-Mobile) initiatives of the government to strengthen its position in the domestic market and increase market share.

Dell is estimating the market from the JAM trinity itself be around $26 billion!

American data storage company Dell EMC sees a $26 billion addressable market opportunity in India for hardware, software, services and consultancy products, as it looks to expand market share in the country.

Things are achanging!

Revolutions happen – quietly

The innovative and the crazy targets of issuing bank accounts to the rural and poor was considered stupid by many. In fact, in the early days these accounts did not have much money balances in them. But that was by design. It was not just about “collecting money”, but creating a direct conduit to the poor.

Those, for whom corruption had been the main money earning opportunity went about trashing the Jan Dhan scheme. Manmohan Singh – the sheepish looking Plunder-in-Chief of the UPA 1 and 2 government, had the audacity to question the opening of hundreds of millions of bank accounts for the poor! To come to think of it, this so-called stellar economist was at one time the Governor of India’s Reserve Bank!

On Wednesday, former Prime Minister Manmohan Singh too criticized the progress of Jan Dhan, saying the Modi government has forced banks to open crores of accounts under the Jan Dhan Yojana, which remain unutilised. “All he (Modi) achieved in these two years is forcing crores of people to open bank accounts. But people are asking what will they do with bank accounts when they have nothing to keep in the bank,” he said referring to the Pradhan Mantri Jan Dhan Yojana.

When you get past his economic mumbo-jumbo and double speak and look at the man straight in the eye to look at his actions the way they were – you realize he is simply doing the “same old, same old” – herding the plunderers via his “Goody-two-shoes” act!

A revolution was being unleashed. For the first time in the history of the world, millions of the poorest, the weakest and the most inaccessible (by banking system) were being empowered. In a way that the middleman would be yanked out of the whole equation. All those who buoyed plunderers like Manmohan Singh and Chidambaram and ran the whole operation of graft and siphoning billions – were in one swift action being made useless. Completely and utterly useless. Because the government money would go around them directly to the poor!

Why less inflation?

When the money goes to the middleman – as it was going all these years, it goes to pockets which push increase unnecessary consumption and often ostentious living. When the money goes into the pockets of the poor in an institutional framework – it brings a sense of security and ability to plan for better way ahead. It opens a glimmer of hope that the poor can hold onto. Those who are poor but without any recourse to pathway for betterment are known to take high risks. Thoe who are poor but who can see the pathway to a better life, walk the pathway. Whenever education has been introduced in poor societies and linked to jobs, similar thing has happened. In those poor societies – like the inner city black neighborhoods in the US – where there is no clear pathway to success, people take high risks (violence and drugs) to hit the jackpot.

Formalization of the economy is not just about bringing order to the structures. It is about clearing the dirt and creating clear pathways. Pathways that lead to a better life. That is all that poor and the needy require. They know survival.

Featured Image: Flickr: Down on the farm