Insightful newsletter of Drishtikone: Issue #236 - India's New Deal

India and its economy is being fundamentally altered right in front of our eyes by a mind which has set fear aside and refuses that emotion to guide his ways.

Image by StockSnap from Pixabay

“Let everything that's been planned come true. Let them believe. And let them have a laugh at their passions. Because what they call passion actually is not some emotional energy, but just the friction between their souls and the outside world. And most important, let them believe in themselves. Let them be helpless like children, because weakness is a great thing, and strength is nothing. When a man is just born, he is weak and flexible. When he dies, he is hard and insensitive. When a tree is growing, it's tender and pliant. But when it's dry and hard, it dies. Hardness and strength are death's companions. Pliancy and weakness are expressions of the freshness of being. Because what has hardened will never win.” ― Andrei Tarkovsky

When one lives in fear - any fear - one does not take full steps in one’s life. Every step is a half step. Because there is a fear of the consequences of taking the full steps and adversaries working against you or situations stacking the odds. So many fears arise of thoughts about things that have not even happened and may never happen. The mind, however, has already incapacitated us because of those fears.

Some men cannot care less. They will deal with the consequences of living a full life as they present. At least, when they are near their end, they will know that they lived a full life worth living.

With so much going on - the pandemic, the Chinese attacks, the global alliance against so many reforms based on falsehoods - anyone else could have come out with a mere incremental budget. In fact, most mortals would have worked for the status quo.

But half a step and half a life is not his way of living. So, India gets one of the most revolutionary budgets in recent times. All the bail-outs and special announcements from Nirmala Sitharaman in the earlier years were building up to this. She and her PM were not looking for quick fixes. But for the real deal.

India’s new journey is now being charted by India’s new deal.

the New Deal

In a 1932 commencement address at Oglethorpe University in Atlanta, Roosevelt discussed how it had become critical for the government to go beyond the normal. The Great Depression had ravaged many economies including that of the US. It was time to look for serious and radical answers.

“The country needs and, unless I mistake its temper, the country demands bold persistent experimentation. It is common sense to take a method and try it: if it fails, admit it frankly and try another. But above all, try something. The millions in want will not stand by silently forever while the things to satisfy their needs are within easy reach.” — Franklin Roosevelt, 1932

One of the things that Roosevelt adopted was - paternalistic demeanor. He wanted to create a different relationship that was based on trust and dialog with his constituency. For that, he started special radio addresses called the fireside chats.

FDR, the New Deal’s public face, got his message to the people through radio addresses called fireside chats, emphasizing that the government was shouldering the burden of shoring up the economy. (Source)

Though many of us may not have realized, PM Narendra Modi has followed many actions and components of FDR’s vision for America.

And, unfortunately, or ironically, destiny has brought his administration face to face with not one but many once-in-a-generation crises.

COVID Pandemic being the latest one.

The current budget and the earlier bail-out and stimulus packages have been created with this vision of PM Modi in mind. What is being created is not a quick steroid shot but an Ayurvedic potion to cure the chronic inefficiencies of the system.

I would see the current budget, which has been hailed by many, as a combination of three things -

Creating further components of Social Safety Net

Injecting capital investments for jobs, increased scale of business, and long term success

Opening up and easing the business atmosphere

We will discuss a few things that will have a major impact going forward.

Safety Net - paradigms have changed

The Varna and vocational groups over the centuries had a way to take care of the entire clan and/or community. There were local versions of banks - which would lend money at easy rates (Patels still have that arrangement in the US where Motel owners can access that) and in case of trouble the local communities would help.

Joint families were another form of a social safety net. When one person was in trouble or incapacitated, the rest of the family would come together to help out.

Most of the rich businessmen would create institutions that would run Dharmashalas across the country. They would provide subsidized or even free lodging and food.

As society changed and industrialization took shape and new business environments started emerging, these social safety nets disappeared.

The devastating impact of lack of adequate social safety nets in modern societies has become all too evident during the pandemic time. So many in the general population have become destitute.

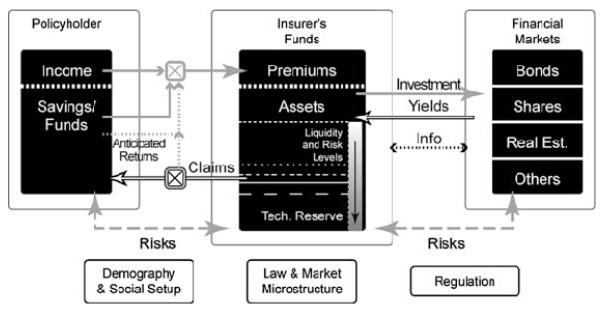

One fundamental change that snowballed the capitalist economies around the world was the identification and administration of property rights. Once the right of the correct owner is enforceable and indisputable, then financial instruments on top of that property can be built.

Options and derivatives, for example, are predicated on the enforceability of property (stocks and underlying assets) rights.

The popular Peruvian economist Hernando de Soto has discussed this in his various works.

Economies grew manifolds due to these changes. But these changes also meant that rich as well as poor could no longer just live on “common land” when things went tough. Those who had the ownership, for every piece of land had an owner now, could evict them. Society took away the right for the poor and destitute to even exist or live without paying.

This scenario has brought societies like India to face situations of abject poverty. What was just a way of life for many Yogis or roaming swamis, became a way of poverty for most over the centuries.

That is why, if India has to come out, specifically after the onslaught of situations like the COVID pandemic, the creation of a strong social safety net is critical.

The safety nets will become even more critical in the coming years when technologies like Machine Learning, Big Data, and Artificial Intelligence fundamentally change the job world. Many of the current outsourcing jobs will be gone.

the new economy, new arrangements, and new tools

So one of the things that this budget did is to extend the social security and health insurance benefits to the gig workers or contractors. Employees' State Insurance is a fund is managed by the Employees' State Insurance Corporation (ESIC). It administers self-financing social security and health insurance scheme for Indian workers. Until now, that was available to employees only. Now, the gig-workers or contractors will be able to get these benefits as well. More importantly, the rules of the minimum wage will apply to the gig workers as well. So all the ride-sharing drivers and workers, as well as IT contractors, will be covered by this.

With the nature of employment changing, this is a very significant step. In fact, this is the first time anywhere in the world such a step has been taken by any government. It will lead to many downstream businesses.

While it will increase compliance for on-demand companies, especially e-commerce and ride-hailing firms, the reforms could kick off an expansion in the human resource management sector for blue-collar workers, according to experts. (Source)

The push for health insurance and systems is critical for that. The JAM trinity and using Aadhar as the basis of public funds transfer is also along those lines. So, new schemes like PM Atmanirbhar Swasth Bharat Yojana will help create the future of the Indian health system. Something that the coming generations will need.

There are so many Indians who are in the US and other countries who want to start companies in India but they cannot on their own because of many requirements specifically for Aadhaar etc. So they have to look for an India-based partner, which is sometimes very tough because they have been away for long. That issue will be also resolved by paving the way for One-Person Companies (OPCs) to take flight. So Indian Citizens who are away from India and the NRIs can now start these companies.

OPCs will be allowed to "grow without any restrictions on paid-up capital and turnover, allowing their conversion into any other type of company at any time, reducing the residency limit for an Indian citizen to set up an OPC from 182 days to 120 days and also allow Non-Resident Indians (NRIs) to incorporate OPCs in India". (Source)

This will be a catalyst to so many ventures.

Another small but fundamentally powerful step is the use of big data, AI, and ML by the Indian government to manage the business portal for compliance. What this particular portal achieves is significant. But what it shows in terms of the government’s mindset and capabilities (remember how Obama’s healthcare portal crashed even after so much work?!) is something very heartening!

MCA 21 portal will be driven by data analytics, artificial intelligence and machine learning features as well as have additional modules such as for e-adjudication and compliance management. MCA 21 portal is used for submitting various documents as part of compliance requirements under the companies law. (Source)

Just these many changes would have been great enough. The budget however goes much further. Let us discuss some of the very critical aspects.

why Insurance sector liberalization is critical

The insurance sector was privatized in the year 2000. At that time the Foreign Direct Investment limit was 26%. It was further increased in 2015 to 49%. The Insurance Act 1938 will be amended to increase the Foreign Direct Investment limit from 49% to 74% in the insurance companies. This will pave the way for foreign ownership.

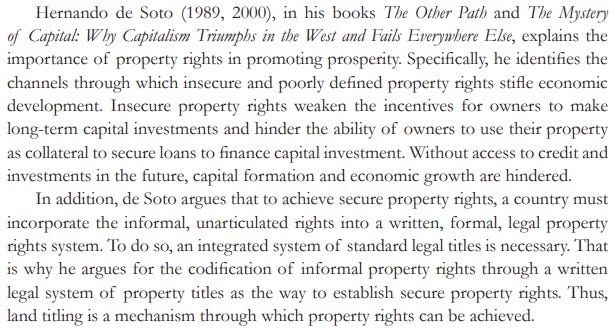

Over the years, the insurance penetration and density have fallen instead of increasing. This may be because of how insurance is traditionally sold in India - as a means for savings and investment and not as protection.

While insurance penetration is measured as the percentage of insurance premium to GDP, insurance density is calculated as the ratio of premium to population (per capita premium).

India has one of the lowest penetrations in the world.

India’s life and non-life insurance penetration in 2019, at 2.82% and 0.94% respectively, are significantly lower than the global averages of 3.35% and 3.88%, respectively, the government's latest Economic Survey showed.(Source)

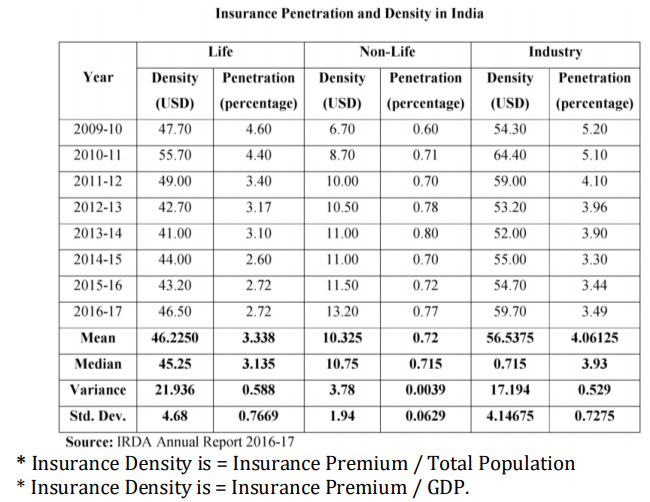

The insurance industry, just like the banks use the money they receive from the insured to invest in the economy.

According to the American Insurance Association, property-casualty insurers operating in the U.S. have more than $1.4 trillion invested in the economy. (Source)

The impact of the insurance sector on GDP is quite significant. In US, it recently was higher than that of the banks.

On an annual basis, the insurance industry’s value added to the GDP exceeded that of banks for the first time in 2015 and has remained above banks. In 2019 the insurance industry’s value-added to GDP stood at 2.9 percent. (Source)

And, that is the point. Everyone studies how the banks impact the economy, but not enough attention has been paid to the overall impact on a country’s economic growth via the insurance sector. The ability to gather and invest money in financial instruments is as huge in the insurance sector as in the banking sector.

A study done in Europe suggests that the insurance industry does have a positive impact on the GDP of those countries. (Source)

The role of insurance companies, although growing in importance in financial intermediation, has received less attention than bank and stock markets and if so, mainly as a provider of risk transfer in single country or very heterogeneous samples. We investigate both the impact of insurance investment and premiums on GDP growth in Europe. We conduct a cross-country panel data analysis from 1992 to 2005 for 29 European countries. We find a positive impact of life insurance on GDP growth in the EU-15 countries, Switzerland, Norway and Iceland. For the New EU Member States from Central and Eastern Europe, we find a larger impact for liability insurance. Furthermore our findings emphasise the impact of the real interest rate and the level of economic development on the insurance-growth nexus. We argue that the insurance sector needs to be paid more attention in financial sector analysis and macroeconomic policy. (Source)

The multiplier effect on India’s GDP is something that one can see in the long term.

setting up the health systems backbone

One of the main thrusts of this budget has been the health of the citizens. In total India will spend Rs 2.23 trillion on healthcare. The PM Atmanirbhar Swasth Bharat Yojana has been launched with a view to strengthening the health systems in the country.

"There are signs that the political, economic and strategic relations in the post-Covid era are changing and ... India is well well-poised to be the land of promise and hope," she said, adding Budget outlay on healthcare had risen by 137 percent. (Source)

Let us look at the most significant schemes started or extended in this budget.

schemes for future growth

Some new schemes were announced and some old schemes were strengthened. (Source)

PM Atmanirbhar Swasth Bharat Yojana: (New Scheme) This will be launched with a total outlay of about Rs 64,180 crore over 6 years. This scheme will become part of the National Health Mission. Objectives include:

develop capacities of primary, secondary, and tertiary care Health Systems,

strengthen existing national institutions, and create new institutions,

to cater to the detection and cure of new and emerging diseases.

Jal Jeevan Mission: (New Scheme) This scheme is being launched for the Urban areas with an outlay of Rs. 2,87,000 crore over 5 years. Objectives will include:

provide 2.86 crore household tap connections

Universal water supply in all 4,378 Urban Local Bodies

Liquid waste management in 500 AMRUT cities

Ujwala scheme: (Extension of Old) This budget extends the existing Ujwala scheme to add more than 1 crore beneficiaries.

Mega Investment Textiles Parks (MITRA) scheme: (New Scheme) This scheme is in addition to Production Linked Incentive (PLI). The objectives are:

Establish 7 Textile Parks to be established over 3 years.

Textile industry to be made globally competitive, attract large investments and boost employment generation & exports

One Nation One Ration card scheme: (Extension of Old) The existing scheme will be extended. Until now it has covered 86% of beneficiaries across 32 States and UTs. The future objective is to integrate the remaining four states in the next few months

Production Linked Incentive (PLI) scheme: (Extension of Old) This scheme is expected to make boost India’s supply chain capabilities. The outlay for this will Rs. 1.97 lakh crore in the next 5 years in 13 Sectors. The objectives will be:

To create and nurture manufacturing global champions for an AatmaNirbhar Bharat

To help manufacturing companies become an integral part of global supply chains, possess core competence and cutting-edge technology

To bring scale and size in key sectors

To provide jobs to the youth

fuzzy budget accounting and Gandhi

“Amount due from Pakistan on account of share of pre-partition debt (approx) Rs 300 crore.”

This is a notation that occurs in every Indian budget since 1948. That was the amount Pakistan had to pay India at an interest rate of 3% in 50 annual installments. Now, that Rs. 300 crores were in 1948. And the interest rate fixed at that time was a meager 3%. If we take that as the basis, then today Pakistan owes India USD 400 million. And if we go by what could be a reasonable interest rate – 10%, then the figures just go out of the roof – USD 22 billion!

After Partition, it was agreed that India would initially meet all the liabilities of the united entity and that Pakistan would then pay back its share of the debt to be mutually agreed. The sum finally agreed upon was Rs 300 crore. The rate of interest was fixed at 3 per cent and Pakistan was to pay back the amount in 50 annually equated instalments starting from 1952. (source)

So, take your figure, but surely it is not Rs 300 crores by any standards! Pakistan Government simply ignored its own obligation and got a pass on that when the pacifist Indian Governments never recovered their receivables!

Now, let us go a little deeper into this issue. After Partition, both Pakistan and India had to also divide the Assets.

According to that India owed Pakistan Rs 75 crores. Indian Government released Rs 20 crores, but withheld Rs 55 crores, presumably after the 1948 Kashmir attack by Pakistan.

Lord Mountbatten, in his oh-so ethical best, went and brought Gandhi up on this. As was his wont, Gandhi went on a hunger strike. And India released the remaining amount. Clearly, Gandhi didn’t understand the basics of accounting!

Assets and liabilities – especially from the same entity – CANCEL each other out! Gandhi was more bothered about the money to be given than money to be taken. Obviously, because no one could fault him for not balancing budgets… for he could easily wash his hands off any responsibility and accountability!

“The decision to withhold the payment of Rs 55 crores to Pakistan was taken by our government which claims to be the people’s government. But this decision of the people’s Government was reversed to suit the tune of Gandhiji’s fast.”

That’s part of the statement of Nathuram Godse on why killed Gandhi. (Other excerpts are below this post.) It is only when you really go into the details of the kind of madness that was so widespread in the name of pacifist nonsense, that you can understand the frustration and anger of a young man like Godse! That someone should have been killed for that is a different question. Gandhi’s actions were irrational and masochistic and did lead to extreme worry in the youth who were idealistic about India’s future.

market corner: 10 quick bytes

Finance Commission keeps tax devolution for states at 41% in FY22 - more

Government targets gross tax revenue of Rs 22.17 lakh crore in FY'22 - more

Bank credit grows by 6.36%, deposits by 11.41% - more

Govt to privatize two PSBs and insurance firms, LIC IPO slated for FY22 - more

Seafood industry to recover in FY22 on strong demand: CRISIL SME Tracker - more

Indian Railways Capex at 64% of annual target at January-end - more

Lucknow Metro uses ultraviolet rays to disinfect trains, sets unique national record - more

Railway board says operating ratio likely to improve to 96.96% by end of the current financial year - more

Gig workers like e-commerce delivery boys, cab drivers likely to come under the security net - more

Government to set up Rs 20,000 crore DFI to promote infra financing - more

nota bene

Fake News Menace: On Monday, Twitter suspended 250 handles for spreading fake news. On this matter, the first reaction from the government has come. In an interview with Zee News Editor-in-Chief Sudhir Chaudhary, Information and Broadcasting Minister Prakash Javadekar opened up about fake news being spread after the Union Budget 2021 was presented. Javadekar cleared that suspension of Twitter handles was entirely the work of Twitter, and it was not the action of the government. (Source)

Protest issue: No major road is now open for the movement of vehicles and people, which is proving to be a growing problem for many passing the stretch. A portion of the road is studded with nails. Concertina wire is a new addition, also mentioned by Tikait while addressing a packed crowd from the main stage. "They have put these barbed wires, not us. They are not allowing people to come to Delhi. We are not the one blocking the roads. If we block roads, they ask us to vacate, but no action is taken when the same is done by these security forces," said. (Source)

On a former Cold War missile base perched high above the Golden Gate Bridge, in what is now the largest marine mammal hospital in the world, Frances Gulland still remembers the shock she felt when she first started working here as a veterinarian 26 years ago. A male sea lion had washed ashore in severe pain. His hind flippers were swollen, his lymph nodes riddled with tumors. Cancer had taken over his kidneys and turned his spine to mush. First responders at the Marine Mammal Center told Gulland they saw this in sea lions all the time. (Source)

Space Courts: Dubai announced Monday the creation of a "space court" to settle commercial disputes, as the UAE—which is also sending a probe to Mars—builds its presence in the space sector. The tribunal will be based at the Dubai International Financial Centre (DIFC) Courts, an independent British-inspired arbitration center based on common law. Space law is governed by international conventions and resolutions, including the UN Outer Space Treaty which entered into force in 1967. Several states have also signed bilateral or multilateral agreements to regulate their space activities. (Source)

Race to Mars: In less than three weeks, on February 18, NASA’s newest Mars rover, Perseverance, is scheduled to land on the Red Planet. At the same time, two other probes, launched by China and the United Arab Emirates, will intercept Mars’ orbit. Perseverance is the 11th Mars probe launched by NASA and the most sophisticated robot explorer ever sent into space. As of last Thursday, the spacecraft was about 25.6 million miles (41.2 million kilometers) away from its destination and was flying toward Mars at a speed of 1.6 miles (2.5 kilometers) per second. (Source)

video corner: slicing through fear

Krishnamurti was a very powerful being. His ability to slice through the mind’s nonsense was just amazing. Here he discusses the ubiquitous emotion - Fear. Fear is what drives so many things in society and our lives. Just listen to his razor-sharp discourse and for a few minutes just close your eyes and be with him.

Today’s ONLINE PAPER: Check out today’s “The Drishtikone Daily” edition. - THE DRISHTIKONE DAILY

SUPPORT DRISHTIKONE: If you consider our work important and enriching and would like to contribute to our expenses, please click on the button below to go to the page to send in your contribution. You can select the currency (for example, INR or USD, etc) and the amount you would like to contribute. Contribute to Drishtikone

If you like this post - please share it with someone who will appreciate the information shared in this edition

If you like our newsletter, please share it with your friends and family