Insightful newsletter of Drishtikone: Issue #244 - Distributed Future

Predatory Big Techs thrive on control of our lives by controlling our information. It is time to revolutionize the tech world. Lead a distributed world of finance, networks, currencies and content!

Image by Dean Moriarty from Pixabay

“the unexamined life is not worth living” ― Plato, Apology

When you are targeted for who you are then may be it is time to know that there must be something unique about you to be so singularly targeted. At that time, it is not good to just lament and cry or fall down. But to take leadership.

And, the world of today, where predatory corporations like Twitter are trying to undermine nation states and their democratic set up, it is time to change the world of technology on its head. If done right, then just like Enron, Twitter may also see a time of oblivion.

Twitter thrives on owning us and our lives by unscrupulously collecting our information and using it against us.

Change the world.

Distribute the data all over.

When a person dies in India, he is cremated. His ashes are distributed in running water so there is no one place where the identity of that person can be pinned to. The departed disembodied being wants to come back to the body making its onward journey difficult. By destroying all sources of physical identity, the disembodied being can move on.

Dispersal of identity is a great way to even push the disembodied away. Let the future be dispersed and distributed.

Defi the future

IN a world that is increasingly being defined by centralized control of a few as they devise cunning ways to collect everyone’s data and manipulate it to set up the foundation of neo-colonialism, there is hope.

Hope in terms of another counter movement - for decentralization. A Decentralization of an extreme nature. No one has the control over data. You control your data and I mine.

Let us investigate this phenomenon and the lessons that come forth.

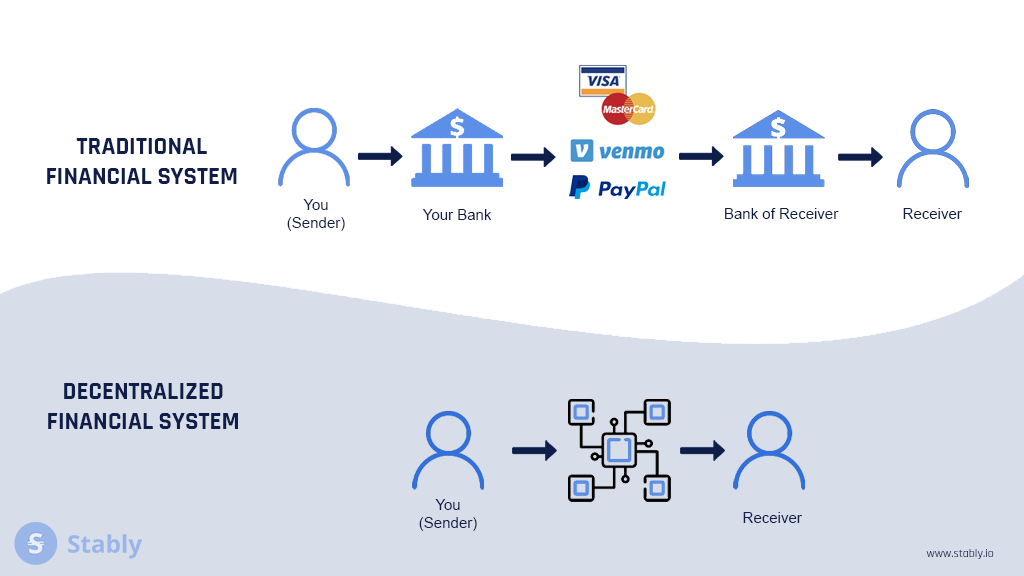

There is a Traditional finance. Or Tradfi. This is the usual banking, investment and other type of financial organizations running the world of money. Even normal payment rails and fiscal institutions would form part of this world.

Defi is the short form of Decentralized finance. What is that? It is a financial sector that is built on public blockchain using software and is open and predictable. It is an open financial system where algorithm as opposed to arbitrary rules are used to create trust and integrity.

The three major points of differences are:

In decentralized finance, a public blockchain acts as the trust source, governing all operations in the financial sector. In contrast, public governance, which entails laws and licensed financial institutions, acts as the trust source, governing all operations in the traditional finance.

Decentralized finance continues to gain traction in part because it is a more open and transparent than traditional finance. The lack of barriers to entry means anybody with programming skills can take part in building financial services and tools on top of public blockchains.

In contrast, cumbersome barriers to entry have made it improbable for the traditional finance system to embrace the emerging trend. The fact that one must obtain proper licenses and authorization from regulators has limited innovation around the traditional finance systems.

The two can be illustrated thus. (Source)

The most critical difference is that for Tradfi, a centralized ledger tracks every transaction in the system. However, for the Defi, there is a decentralized or distributed ledger that is held by individuals on the network of machines integrated by block-chain protocol without any need for a central authority.

Decentralized finance started gaining prominence as a replacement for the traditional finance system in 2018 when 15 Ethereum-based projects came together with the aim of building an independent, secure, and open financial system. Some of the early proponents behind the DeFi movement included MakerDao, Origin Protocol, and Paradigm. (Source)

Ethereum based framework has enabled this new generation of finance and other applications possible on block chain.

What is Ethereum? It is a blockchain network pioneered by Vitalik Buterin, Gavin Wood, and Joseph Lubin in 2014. This open software blockchain network provides a decentralized platform that supports smart contracts. The Ethereum Virtual Machine is the foundation for various distributed applications (dApps).

Ether (ETH) is the cryptocurrency token that allows for transactions between participants in the Ethereum network, and it is the second-largest blockchain token by market capitalization after Bitcoin. (Source)

Even social networks are being launched based on Ethereum like Sapien network.

Ethereum-based social network Sapien has unveiled updates to its platform, as well as a partnership with the initial exchange offering project, Matic Network. “After several months of development, we’re launching the next release of our platform, called Alpha Persei,” Sapien Network co-founder and CEO Ankit Bhatia told Cointelegraph in an interview. (Source)

I have tried to create an account and check inside the network and it seems quite interesting. It has tribes instead of groups and you can connect with people who share your interests and post links, videos, and images.

In fact, there is a move to create block-chain based online wallets which help people store and transact cryto-currencies. One of the most popular wallets based on Ethereum called MyEtherWaller (MEW) has also recently ventured into hosting sites.

There is growing frustration with Facebook, YouTube, and Twitter over increasing censorship. MyEtherWallet (MEW), an accessible Ethereum wallet interface, has announced the launch of “Host Your Own Site,” a new service that will enable its users to post virtually uncensorable content online. The new service uses the InterPlanetary File System (IPFS), a peer-to-peer network for storing and sharing data in a distributed file system. “Wallets don’t have to be just for payments anymore,” said MEW founder Kosala Hemachandra. (Source)

The new generation of entrepreneurs are working on innovative products to revolutionize the world of social networks, finance, hosting, and creating websites.

The latest integration with the Opera browser will allow users to access blockchain-based domains. By typing “.crypto” as one would type “.com,” Opera users will now be able to access decentralized websites. Decentralized websites are those not hosted on centralized servers like Amazon Web Services. Using services like Amazon’s, news outlets, and businesses hand off control to a third-party. The third-party then has the power to cut off access and effectively end a website. (Source)

The cloud of tomorrow will not resemble the cloud networks of today. No one will be able to own your data. Even browsing, as Opera is showing and as some companies are extending browsers like Chrome are demonstrating - can become the window for the new block-chain applications.

Why is this important to us?

As the battles between unscrupulous predatory companies like Twitter and various Nation States escalate, there is a hunger for new and more independent networks.

The Indian government and various entities have moved to apps like Koo.

Is that a wise thing?

The answer is No!

This is an opportunity to take a lead in the world.

Let us look at some interesting data points.

Ethereum and Bitcoin networks globally have moved over $1 Trillion in volume in 2020. That is more than Paypal! (Source)

There is a website - coinmarketcap.com - that lists the prices of crytocurrencies. It’s Alexa ranking is higher than even Wall Street Journal’s site wsj.com

More importantly crytocurrencies and blockchain cannot be brought down by any entity.

Balaji Srinivasan, a VC discusses why the Indian Government should take a lead in establishing itself in the cryto-currency world.

First, some definitions. A digital rupee would be a centralized currency controlled by the Reserve Bank of India (RBI), while Bitcoin and Ethereum are decentralized international cryptocurrencies that no single actor has control over. The administrators of the digital rupee at RBI would be able to issue wallets, freeze accounts, and reverse transactions. But Bitcoin is more akin to digital gold, and cannot be frozen or seized by any state. It is this property that makes Bitcoin so precious for safeguarding Indian national security. A network that cannot be shut down by any state is a network that India and its diaspora can rely upon in times of conflict. For the same reason that Germany recently repatriated 3,378 tons of gold from the United States, India should prioritize national support for digital gold as a financial rail of last resort in a situation like the 2008 financial crisis or the 2020 COVID crash. (Source)

You see in this day and age of fake journalism and outrage-based policies by American establishments and think-tanks, anything is possible.

Recently, many celebrities started sharing fake images of wirld-fires from Amazon forest and sharing their outrage. (Source) Based on that, one writer on the journal “The Atlantic” even went ahead to push for invasion of Brazil! (Source)

Given how things are going these days with the propaganda against India, do you think such a thing is not possible against India or the Indian establishment?

So what should India do?

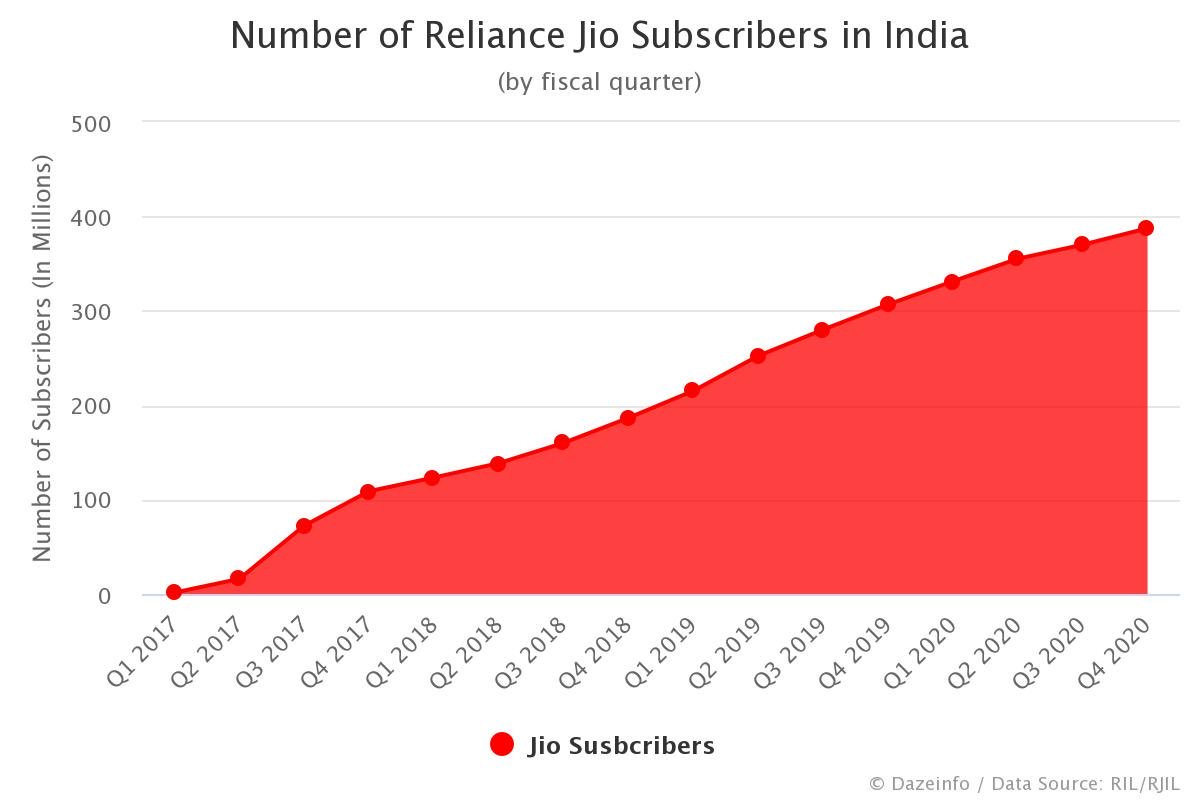

India has a very large population which is increasing coming online and succeeding in creating e-commerce opportunities or other career avenues. Ambani’s Reliance Jio has helped in that.

Balaji shares five actions that PM Modi should take. But two of them are critical to ensure India takes leadership in the new financial world. (Source)

Create a digital rupee backed by digital gold. Shelve the proposed crypto ban and instead buy Bitcoin to back a digital rupee, making it the first national digital currency backed by digital gold. Even if the RBI doesn't want to peg the digital rupee to digital gold right away, it'll be useful to have BTC reserves as a backstop in a few years time.

Add crypto to IndiaStack. Update IndiaStack to add on-chain accounting and a "stockchain", with the goal of putting the country's financial system – currency, payments, accounting, stocks, and more – entirely on-chain by 2030. With cryptographically provable financial statements, trust in Indian companies would rise and foreign investment would flow into the country.

The new world is different and India is poised for a big leap.

Interestingly enough, backed by Niti Aayog, the Indian establishment may be moving towards an indigenous block chain network of its own. Last year, The National Payment Corporation of India (NPCI) made a low key announcement that is quite interesting.

The National Payments Corporation of India (NPCI) has unveiled an enterprise blockchain platform called Vajra to automate payment, clearing and settlement of transactions. (Source)

What is Vajra?

The National Payments Corporation of India (NPCI) has launched the Vajra Platform to make payments fast and secure. Based on blockchain technology, the primary highlight of the Vajra Platform is that it automates clearing and settlement of payments, drastically reducing the need for manual reconciliation. (Source)

The impact of what United Payments Interface (UPI) (read - Issue #215 - The UPI/RuPay Juggernaut) and the new direction of Indian financial payment systems is taking is taking its toll on the international players. Paypal is exiting the Indian domestic market!

PayPal operations in India are drawing to a close as the company makes plans to exit the domestic payments market in the country, according to an Economic Times report on Friday (Feb. 5). The move is intended to streamline operations in India’s cutthroat market for online payments. Domestic operations include PayPal’s payments gateway and aggregator services for online merchants and brands. The Silicon Valley financial services firm will soon alert its merchant partners in India that all contracts will be terminated on April 1, an anonymous PayPal spokesperson told ET. (Source)

Building up on the blockchain Vajra platform for payments, there are now reports that Reserve Bank of India is moving ahead with exploring the creation of Central Bank Digital Currency (CBDC). A Digital Rupee!

Nevertheless, RBI is exploring the possibility as to whether there is a need for a digital version of fiat currency and in case there is, then how to operationalise it. (Source)

An indigenous block-chain platform powering a Digital Rupee, a sovereign cryptocurrency, which would enable a payment system based on UPI as the payment rail. Even UPI can in future be block-chain based as well. This entire combination could be the greatest leap forward in the world of finance and economics!

The next step would be to allow Vajra to be used for creating social network, email, hosting, and cloud applications.

market corner: 10 quick bytes

Koo cofounder refutes French hacker’s data leak claim; says Chinese investor Shunwei to exit company soon - more

Non-basmati rice exports more than double to Rs 22,856 crore during Apr-Dec 2020 - more

Britain’s ‘Kent’ coronavirus variant a concern, ‘likely to sweep the world’, says scientist - more

India to overtake EU as world’s third largest energy consumer by 2030: IEA - more

Shell says to invest $5-6 billion annually in green energy - more

Ola to deploy ABB automation solutions for the rollout of electric scooters - more

Biden seeks more foreign workers while skirting H-1B visa uproar - more

Urban Indians avoided eating out, large stores; 4 in 10 preferred online shopping during the pandemic: Survey - more

Why PM Modi's private sector defense is a watershed in India’s political economy - more

The government saves Rs 15,000 crore by reducing pulses import - more

nota bene

NIA files cases against SFJ: The National Investigation Agency (NIA) has filed a charge sheet before NIA Special Judge, Mohali, Punjab against six accused in a case relating to the hoisting of a Khalistani flag at DC office complex in Moga by members of Khalistani group ‘Sikhs for Justice’. The accused had hoisted the Khalistani flag on the government building on 14th August last year, removing the national flag. (Source)

ED raids NewsClick offices: On February 09, Enforcement directorate raided at the home of NewsClick founder and Editor-in-Chief Prabir Purkayastha. Soon after, Editor’s Guild of India claimed that the raids are an attempt to curb the Freedom of Expression of press and media. However, sources have revealed that ED found several incriminating documents and suspicious financial transactions. According to the sources in ED, NewsClick had received Rs.10 crore under Foreign Direct Investment (FDI) from an American company. Interestingly, NewsClick’s owner Prabir Purkayastha has no idea for what purpose the American company transferred the money to his company’s account. He could not give any proof of work that he has done for the particular company. (Source)

Follow Indian Laws, Govt to Twitter: Social media companies will need to follow India’s laws or face strict action, minister for electronics and information technology Ravi Shankar Prasad said in Parliament on Thursday, while adding that the government is working on new rules to make companies such as Twitter and Facebook more responsive to directions and accountable to Indian laws. Prasad said the government was in the favour of freedom of speech and expression but warned that the abuse of social media platforms for harms such as fake news and election manipulation will not be tolerated. (Source)

Facebook to scale back Political content: Facebook will start scaling back all political content in its News Feed for some users, including posts from people's family and friends, as part of a trial to test ways the social media giant can rank posts on its platform. The company said on Wednesday it would temporarily reduce the political content for some users in Canada, Brazil and Indonesia this week and in the United States within the coming weeks. (Source)

Earth had no mountains for many years: Earth, like so many of its human inhabitants, may have experienced a mid-life crisis that culminated in baldness. But it wasn't a receding hairline our planet had to worry about; it was a receding skyline. For nearly a billion years during our planet's "middle age" (1.8 billion to 0.8 billion years ago), Earth's mountains literally stopped growing, while erosion wore down existing peaks to stumps, according to a study published Feb. 11 in the journal Science. (Source)

video corner: future of US Strategy in the Indo-Pacific

Indo-Pacific is the new mantra for the Asia based alliances backed by the QUAD - India, Australia, Japan and the US. Lisa Curtis, an ex-CIA analyst and in the Trump administration discusses what this alliance is and its importance in the coming days, specifically with Biden in command.

Worth a listen to understand the minds behind the establishment in the US.

Today’s ONLINE PAPER: Check out today’s “The Drishtikone Daily” edition. - THE DRISHTIKONE DAILY

SUPPORT DRISHTIKONE: If you consider our work important and enriching and would like to contribute to our expenses, please click on the button below to go to the page to send in your contribution. You can select the currency (for example, INR or USD, etc) and the amount you would like to contribute. Contribute to Drishtikone

If you like this post - please share it with someone who will appreciate the information shared in this edition

If you like our newsletter, please share it with your friends and family