Drishtikone Newsletter #353: The Chinese Ponzi Economy

Mortgage Revolt due to the real estate crisis in China has hit the banks hard. The manufacturing sector is reeling. Is China a giant Ponzi scheme waiting to unravel?

“This person has just arrived on this planet, knows nothing about it, has no standards by which to judge it. This person does not care what it becomes. It is eager to become absolutely anything it is supposed to be.” ― Kurt Vonnegut, Slapstick, or Lonesome No More!

Bankei Yōtaku was a Japanese Rinzai Zen master. He was the master at Ryōmon-Ji and Nyohō-Ji. One day a Shinshu priest came to Ryōmon-Ji temple. He believed in the enlightenment by repetition of Buddha’s name.

The priest saw large crowds at Bankei’s sermon and wanted to debate with him.

So he bragged:

“The founder of our sect, had such miraculous powers that he held a brush in his hand on one bank of the river, his attendant held up a paper on the other bank, and the teacher wrote the holy name of Amida through the air. Can you do such a wonderful thing?”

Bankei calmly replied:

“Perhaps your fox can perform that trick, but that is not the manner of Zen. My miracle is that when I feel hungry I eat, and when I feel thirsty I drink.”

Attainments in life do not mean that you do extraordinary things. But you do ordinary things with full involvement such that they become extraordinary.

The fetish with miracles has been the most vicious obsessions of the human race. It has led to such unspeakable crimes that it would shame humanity.

The problem with most powers has been they have tried to conquer the world - look miraculous. But they turned out to be nothing more than harbingers of misery and destruction.

When Mao Zedong started the Great Leap Forward and pushed in a direction to move ahead while jettisoning China's complete civilizational history and replacing it with the questionable communist ideology he engineered the greatest death dance where as many as 30 million people perished! The edifice of "modern" China was built on their graves. And the ruins of a civilization that was ancient, wise, and spiritual.

Where does it stand today?

When the whole economy is a giant Ponzi scheme

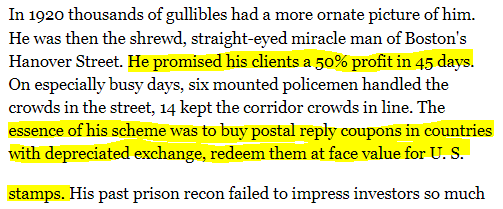

Charles Ponzi, also known as Charles Ponci, Ponzi, Carlo, and Charles P. Bianchi was a swindler in the earlier part of the 20th century. He promised his investors 50% profit in 45 days. He was using the money from the latest investors to pay the earlier ones.

IN 2017, an opinion piece in South China Morning Post said that the Chinese economy, in reality, was a Ponzi scheme really.

If the demand faltered, Jake Van Der Kamp predicted that this Ponzi scheme pushing the manufacturing sector up - will collapse.

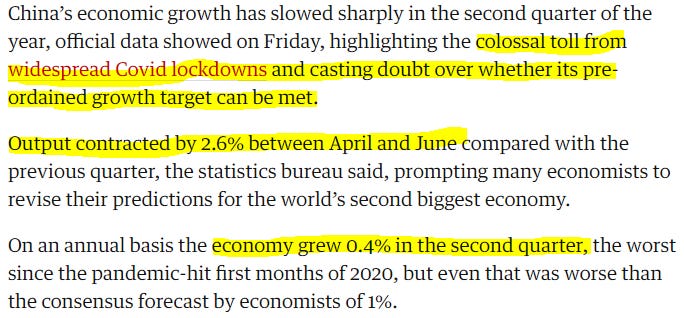

That faltering in global demand came with the COVID-19 hit that created an economic slowdown the world over. More importantly, it hit the manufacturing and society in China itself.

Although the Chinese economy grew by 18.3% in the first quarter of 2021 compared to the same quarter last year (Source: BBC), this year - 2022 - after multiple lockdowns, the Chinese economy has been hit very badly.

The Chinese Communist Party (CCP) politburo had predicted annual growth of 5.5% in April 2022. In July 2022, the International Monetary Fund put that growth to 3.3%. (Source: IMF) From 18% to 3.3%!

Wierdonomics!

Let me show you something quite interesting.

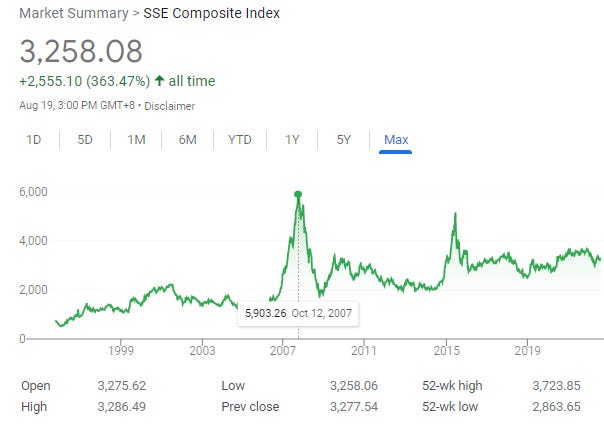

The Shanghai Stock Exchange (SSE) Composite Index - China's main stock market index - is currently at 55% of its highest level. That peak was way back in October 2007.

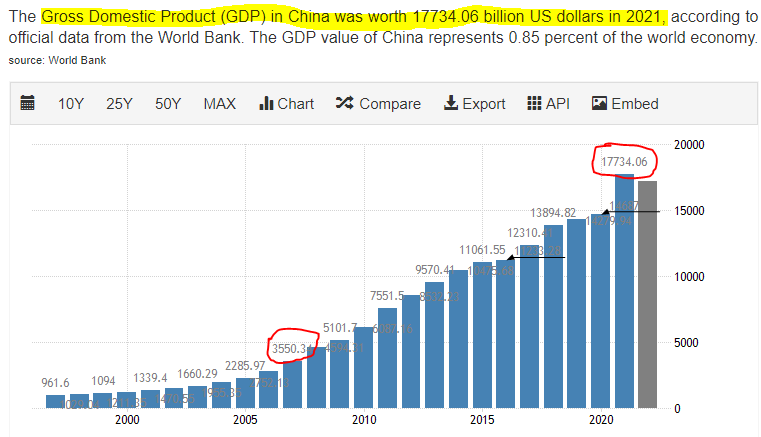

The SSE Index was at its highest when the Chinese economy was 5 times smaller (USD 3550 bn in 2007 to USD 17,734 bn in 2021)!

What about the Per Capita GDP? That increased 2.6 times during the same period - from $4319 to $11,188. Impressive economic progress!

But heck, does that even make any sense? The economy grows 5 times and Per Capita GDP increased 2.6 times, but the Capital market shrinks by a whopping 45%?!

Here is the question that no one has even asked.

So where the heck was all the money that the rising income levels with the extremely high savings rate of the Chinese people would have generated going to?

Bizarre is an understatement!

To understand the Chinese economy and this unusual conundrum, it is important to understand its components.

Chinese Real Estate: the greatest Ponzi scheme

Real Estate is the most important component of the Chinese economy and quite clearly the biggest driver of its economy.

The middle class in China loves to save and over the years, it has funneled over 70% of its wealth into the real estate market (Source: Fortune) By comparison, Americans have 35% of their wealth in real estate.

Depending on the sources, the property sector accounts for between 25-30% of China's GDP!

Much of the Chinese middle class invests in real estate. In China, the real estate sector accounts for around 24 percent of gross domestic product (GDP) – almost a quarter of the nation’s GDP. However, debt grew alongside the boom in real estate after 1998. Apprehensive of the financial disaster that might result if the situation remained unchecked, in 2020 the Chinese government introduced a policy to oversee and handle loan regulations for the real estate sector, commonly known as the “three red lines.” The policy requires developers to meet three criteria to forestall debt risks: a liability-to-asset ratio lower than 70 percent, net debt-to-equity ratio of less than 100 percent, and a ratio of cash to short term borrowings of less than 1. (Source: The Diplomat)

This real estate sector growth was predominantly fueled by household savings and the extremely pro-builder rules and laws.

As per Nomura analysts estimate the developers have delivered only 60% of homes that they had pre-sold and taken money for between 2013 and 2020. Meanwhile, the mortgage loans increased by 26.3 trillion yuan ($3.9 trillion) in that same period. (Source: Nikkei)

Per the Chinese laws, it is allowed that real estate firms can sell the homes even before completing them. Worse, the customers have to start replaying their mortgages before the customers even get possession of their homes.

Needless to say that the real estate builders use the funds to finance the construction. But they also go ahead and run this whole process like a classical Ponzi scheme. (Source for the list below - PolisPandit)

Chinese households allocate most of their savings to real estate. Approximately 30% of China’s GDP comes from real estate compared to 15-18% in the United States.

The Chinese government has never let the real estate market fall, and has historically intervened to assist developers and banks. Accordingly, investment in Chinese real estate promises high returns with little to no risk.

It is standard for property developers to sell housing long before projects are completed. Home buyers in China are required to start paying the entirety of their mortgage before their home is completed and delivered.

Developers use these pre-sale proceeds to fund land purchases and to further expand their business. Therefore, new investment drives liquidity and cash flow.

Whenever financing conditions have tightened, developers were quick to start new projects, securing more pre-sales and stabilizing cash flow.

However, as the Chinese real estate market cooled and developers failed to complete projects in a timely manner, less home buyers were buying pre-sales, and existing customers threatened mortgage boycotts when their homes were not completed on time.

Therefore, it is only a matter of time before the systemic risk becomes too great, developers do not have necessary cash flow to finish projects or start new ones, and home buyers lose confidence and stop funding pre-sales. At that point, the Ponzi scheme will collapse.

On August 27th last year, in a spectacular display, Chinese authorities demolished 15 unfinished buildings in the city of Kunming in Yunnan Province. 15 buildings that had been lying unfinished for 7 years were brought down in mere 45 seconds!

The whole unfinished real estate scenario led the homebuyers to refuse payments of their mortgages leading to a banking crisis.

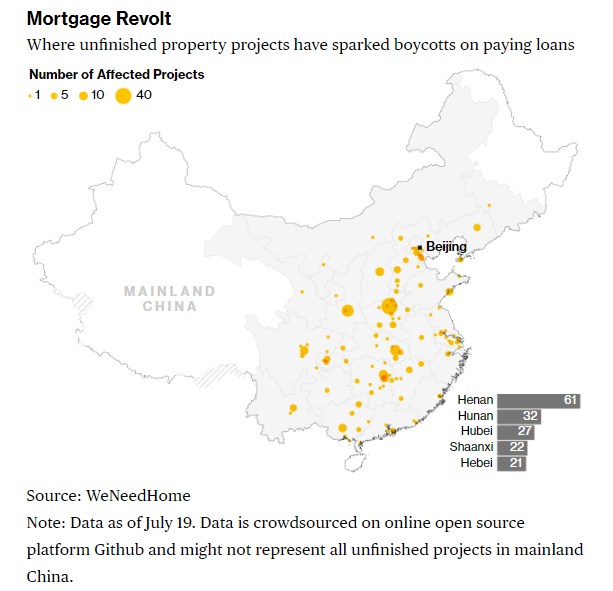

Property construction in China has slowed over the last two years for reasons including COVID-19 movement restrictions and a cash crunch that constrained the financing of construction activities. Now, tens of thousands of homebuyers — as estimated by Bloomberg — in China are refusing to pay their mortgages for uncompleted apartments. More than 320 projects in the world's second-largest economy are at risk of boycotts, according to crowdsourced data on GitHub account "WeNeedHome." The halt in construction activity could impact 4.7 trillion Chinese yuan, or $696 billion, worth of homes in China. It would take 1.4 trillion yuan, or 1.3% of the country's GDP, to complete the construction projects, Bloomberg Intelligence analyst Kristy Hung estimated. (Source: Business Insider)

1.3% of the Chinese GDP - that is what it will take to make the Chinese property market whole again!

This mortgage revolt, as it is being called, in China is quite widespread.

Let us understand the main players in the Chinese property market to have a better appreciation of the scale and the extent of the rot!

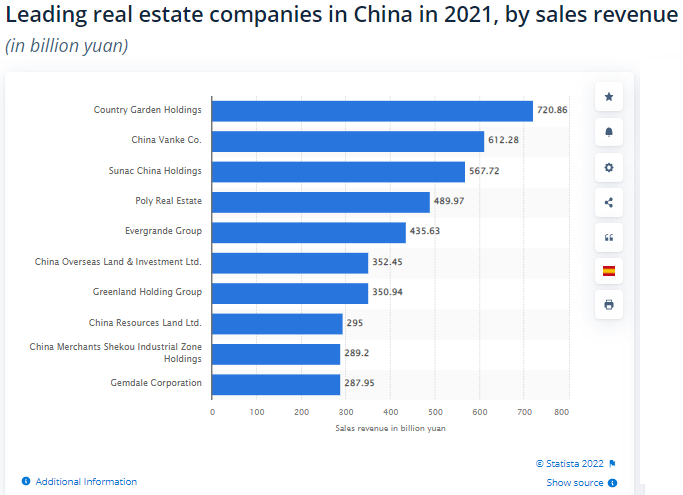

Country Garden is the largest and in 2017, Evergrande was the second largest (Source).

Evergrande defaulted on its debt in 2021 (Source: CNN) and then other companies followed suit.

Sunac defaulted in May 2022 (Source) and Shimao defaulted in July 2022 (Source). The property market in 100 cities in China has plummeted by over 40%!

On Friday, a survey by China Index Academy — a property research firm — showed that prices for new homes in 100 cities plunged more than 40% in the first half of this year, compared with the same period last year. (Source: CNN)

Also, just last week, we learned that the cash flows of the property builders have reduced drastically.

Developer cash flows through July are down 24% year-on-year on an annualized basis, according to analysis from the firm’s lead economist, Tommy Wu. That’s a sharp slowdown from growth for nearly every year since at least 2009, the data showed. Total funding as of July was 15.22 trillion yuan ($2.27 trillion) on an annualized basis, versus 20.11 trillion yuan in 2021. The drop comes as credit demand in China missed expectations in July, and property developers’ struggles drag on. (Source; CNBC)

And then comes the news that the largest property builder Country Garden has warned of a whopping 70% drop in its profits.

So why should all this be a great cause for concern?

Because real estate loans are a major part of the banking sector. 26% of the total banking sector credit to be precise!

The investigation underscores the challenges for Beijing in its efforts to encourage banks to extend fresh loans to embattled real estate developers, while managing lending risks. Property loans accounted for 25.7% of total banking sector credit in China as of end-June, Chinese central bank data showed. The banking sector's total outstanding loans was 206 trillion yuan ($30.3 trillion) at the end of the first half. (Source: Reuters)

So let us play that and the information we know until now back.

Property builders are defaulting on loans as their cash flows and profits plummet. Up to 70% drop in profits!

Property loans account for about 26% of the banking sector's total credit

The banking sector's total outstanding loans were $30 trillion

70% of Chinese citizens' wealth is invested in the Real estate market

The Chinese real estate market has plummeted by 40%

The Chinese real estate market accounts for 25-30% of China's GDP

Does it need a rocket scientist to figure out that a collapse of the Chinese real estate market and the all-powerful property builder companies will take China's banking sector down with it?

As they are doing.

The banking industry - specifically the important rural banks - in China has been badly impacted. Henan province banks - Yuzhou Xinminsheng Village Bank, Shangcai Huimin County Bank, Zhecheng Huanghuai Community Bank, and New Oriental Country Bank of Kaifeng and Guzhen Xinhuaihe Village Bank in the neighboring Anhui province have been the worst hit. Around 40 billion yuan (US$6 billion) deposits have been frozen deposits in online accounts due to first wave of bank runs in China. (Source: Foreign Policy and South China Morning Post)

That they are "rural banks" may make one underplay their importance within the Chinese economy. The truth is that they make up 32% of the entire commercial banking sector with $14 trillion in total assets. For comparison, please remember that the total assets of the US commercial banks are around $23 trillion. (Source: ycharts)

The malaise goes far deeper, posing a potential threat to economic stability in some Chinese provinces, particularly rust-belt ones like Liaoning. The 134 metropolitan and 1,400-odd rural commercial banks in China make up about 32% of its commercial-banking sector, with some 90trn yuan, or $14trn, in total assets. That is almost the size of Britain’s entire banking system. They exist in the shadow of China’s six big national-level banks and 12 joint-stock banks, which are predominantly state-owned and have the most visibility. Unlike the bigger banks, during most of the past decade many of those in the lower tiers have sold ownership stakes to large private investors, to the point of being under the influence of them. In recent years some have become cesspools of bad debts, insider dealing and failures of risk management, which are often attributed to misaligned ownership incentives. (Source: The Economist)

But what about the top banks in China?

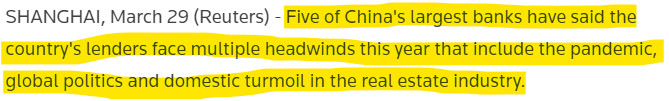

This is what the top executives of these banks have recently said (March 2022).

China Construction Bank Corp (CCB) - second-biggest lender by assets: China's banking industry is facing "a more complicated and severe business environment." Bank of China (BoC) - fourth-largest bank by assets: "The global epidemic will continue to recur, the easing policies of developed economies will be withdrawn, geopolitical conflicts will intensify." Bank of Communications Co Ltd (BoCom): “it would be difficult for the bank to deliver satisfactory earnings this year”

Basically, they have given a combination of the pandemic, global politics, and the real estate industry.

Headwinds? That's cute.

Meanwhile, as is the wont of Washington Post and Bloomberg journalists these days, Anjani Trivedi makes a spirited case for "All is well" with the Chinese economy in a Washington Post article titled "Don’t Believe the Grim Forecast. China Is Just Fine" What next? Justifying the moon landing hoax?

Her argument is - Foreign Direct Investment is still pouring into China, so what's wrong with the economy?

In addition, despite what the sentiment surveys tell you, foreign direct investment into China’s high-tech manufacturing increased 31.1% in the first six months of the year. South Korean investment climbed 37.2%, while the US was up 26.1%. (Source: Washington Post)

That seems interesting as a polemical argument for the Chinese economy but it completely misses the extent and the depth of the interdependencies between major sectors that are taking a beating already. As for the influx of FDI even now? We all know how many investors keep chasing bad investments with good money with the hope that they can turn things around.

Ponzi schemes may take long to unravel, but when they do, they take a lot of livelihoods and lives down along with them!

More importantly, Trivedi misses the domino effect in this whole crisis.

Now let us go to the other major elephant in the room - the manufacturing sector of China.

Manufacturing Sector: How the Chinese government subsidized the world

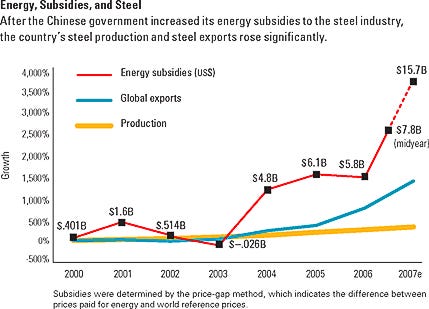

In June 2008, Harvard Business Review ran a research insight piece from Usha CV Haley and George T Haley which showed how the Chinese steel industry grew massively not on the back of the low-cost labor, as was being promoted by most experts, but because of massive government subsidies.

Many assume that China’s cost advantage in manufacturing comes from cheap labor. But in China’s burgeoning steel industry, our research suggests, massive government energy subsidies, not other factors, keep prices down. These subsidies have broad implications for how companies compete and collaborate with Chinese businesses. (Source: Harvard Business Review)

This chart shows it all.

The Haleys followed up with another article in 2013 that started with another case study - the Solar industry.

LDK Solar, the Chinese manufacturer of solar wafers and panels had defaulted on its bond payments. This also coincided with the bankruptcy of another solar company Wuxi Suntech, a subsidiary of the world's largest solar panel makers at that time. Interestingly, this was right at the time when the Chinese government subsidies to the solar industry had declined. It was this financing - subsidies grew 10 times from 2008 through 2012 - that had made the Chinese industry experience an explosive market. So while the solar panel sales were going through the roof for these Chinese manufacturers, their debt ratios were well over 80% by 2012!

The Haleys surmised that without these subsidies, the solar manufacturer would have collapsed.

What had started off as a predominantly labor-intensive sector - the manufacturing sector (37% in 2000) had changed after the first decade itself (fell to 14% by 2010). Source: "How Chinese Subsidies Changed the World" - Harvard Business Review

The myth was that the Chinese companies had a major labor cost advantage. They didn't!

Another myth was that Chinese industry had economies of scale. It didn't!

The fact was that in industries that the Harvard Business Review article discussed - solar, steel, glass, paper, and auto parts - labor was only 2-7% of the whole cost. How much could that sucker even help the companies churn out low cost products?

Most of the cost was of the imported raw material and energy.

China's energy costs Vs US: "Contrary to popular belief, electricity in China is already expensive. On average, retail electricity prices in China are only about 15 percent lower than in the United States, and for many Chinese provinces electricity prices are no different from the average U.S. Midwestern state. [10] What is different about the United States and China is how these prices are distributed across customer classes. In the United States, residential and small commercial customers pay the highest prices, followed by larger commercial and then industrial customers. In China, commercial and some industrial customers pay high prices, while heavier industry, agriculture, and residents pay lower, heavily subsidized prices" (Source: Wilson Center)

China's energy costs are not that drastically different from the ones in the US. Do you get the picture?

Worse still, the production was also done in small companies which had little economies of scale.

Despite all this, the Chinese companies were selling at 25-30% lower cost than those from US and EU.

How?

Subsidies from the Government. Both, Central and Provincial.

While talking to my friends almost 10 years back, I once exclaimed how the Chinese government loves the Americans while laying out why. [On Drishtikone we were asserting that the Chinese economy is a giant Ponzi scheme as far back as 2011 - Is the Chinese Economy Bubble about to break?]

A major portion of my grocery and household bills at Walmart and the various stores are actually paid by the Chinese government!

Let me put it another way - the Chinese government has been substantially financing the households of the American (and European) middle class for the last 30 years!

The day it falters, as it seems will happen soon, the party will be over. American middle class will immediately get a 40-50% pay cut within a year.

The HBR article discussed how the Chinese subsidies were the death knell for the American and European companies.

Because of massive Chinese subsidies to several industries, no free trade exists and markets have failed. To survive, U.S. and European companies must seek government support to open Chinese markets and to protect themselves from subsidized products domestically. And national governments and trade blocs must heed these calls. If they don’t significantly increase pressure on Chinese governments and businesses, the devastation that Chinese subsidies have wreaked on other countries’ economies will continue. (Source: Harvard Business Review)

Yes, they were.

But it was not as if the Chinese government was creating some stellar companies which could take on the world based on its talent on the back of these subsidies.

The companies were just beating their competition due to unfair subsidy advantage. They would fold just as soon as the subsidies well.. subsided!

China has been adopting a “mercantilist” policy by lavishing massive government subsidies on Chinese firms. Using hand-collected subsidy data on Chinese listed companies, we find that firms receiving more subsidies tend to have a lower cost of debt. However, such firms fail to have superior financial performance. Instead, firms with more subsidies tend to be overstaffed, which demonstrates higher social performance. These results are mainly driven by non-tax-based subsidies rather than tax-based subsidies. Overall, our results suggest that the Chinese government uses non-tax-based subsidies to achieve its social policy objectives at the expense of firms’ profitability. (Source: "China's “Mercantilist” Government Subsidies, the Cost of Debt and Firm Performance", Science Direct)

More importantly, how was the Chinese government financing these subsidies?

Through the very large domestic savings.

China not only accounts for almost one-third of global greenhouse gas emissions, its financial system is also the second largest in the world. Fueled by exceptionally high domestic savings—at about 45 percent of GDP China’s savings rate is among the highest in the world—its largely state-dominated banking system alone has accumulated assets worth almost $50 trillion. (Source: Brookings Institute)

That famed banking sector and savings (substantially put into the Chinese real estate market) is what is at risk currently!

So, the question from the HBR studies should not have been: How will the US and EU companies and governments counter the Chinese subsidies?

But - how will the Chinese government keep running the Manufacturing Ponzi scheme built upon the Real Estate and the Banking Ponzi Schemes which could all unfold at the same time?

Given the size and scale of the Chinese economy backed by the military and economic power ($3.13 Trillion in forex reserves) it has amassed, China will not implode. It will remain a power for long. But things will start changing around its own structure, size, power, and governance when the overall impact of the many Ponzi schemes its economy hides start unraveling. And, the rest of the world will not be immune as well.

Video Corner: Demolishing Hindumisia in Indian media

Rajdeep Sardesai, the trashed and regularly rubbished journalist that he is, interviewed Vivek Agnihotri, director of "The Kashmir Files".

During the interview, Rajdeep tried to construct a narrative that the current scenario in the Bollywood movie market is a new phenomenon where the "right-wing Hindus" were trying to hurt a few movie makers while pushing the movies of some like Vivek Agnihotri.

If the audience that boycotted or refused to watch Raksha Bandhan and Lal Singh Chadda are "fringe" (which the 'right-wing' tag usually connotates) then how did the movies bomb so spectacularly across India and the world? If the failure of these movies is as widespread and consistent as it is obvious, then the 'boycotting group' is not just unanimous but not some "crazy group" that 'hates' you! It IS your WHOLE audience!

This whole idea that anyone who decides that she would not allow herself to be a target of a hate crime is preaching hate herself is the most egregious gas-lighting technique out there. And it has been perfected by the left-wingers. Nobody puts this hypocritical stance in its place better than Denzel Washington!

0:00

The fact is that anti-Hindu and anti-Indian along with pro-Muslim and pro-Pakistani stereotyping has been central to Bollywood movies since the 1960s!

Entrenched Hindumisia in Bollywood

An IIM-A research team led by Dheeraj Sharma randomly selected 50 films from the 1960s, 1970s, 1980s, 1990s, 2000s, and 2010s. (Source: Stereotypicality in Indian cinema is not a healthy trend)

They picked up 2-3 movies per letter to create a list of 50 movies per decade.

The results showed the following trends:

In nearly 78% of the movies promiscuous women had a Christian name;

58% of the corrupt politicians in films had a Hindu brahmin last name; and,

62% of the corrupt businessman in films had a vaishya last name.

84% of the Muslims in films were shown as strongly religious and honest (even when they are shown in the film as engaged in crime) and

88% of the films presented Kshatriya last-name individuals to be courageous.

74% of the films presented Sikhs as laughable. In addition, we examined 20 Bollywood movies that had Pakistan as the setting. In 18 of 20 films that had a Pakistani setting, Pakistanis were projected as welcoming, courteous, open-minded, and courageous

In those 20 movies, the Pakistan government was demonstrated as fundamentalist, unwelcoming, and jingoist.

However, in the same movie, Indians were largely projected as narrow-minded, unwelcoming, and conservative.

Indian government officials were however largely shown as neutral, standoffish, procedure-oriented, and indecisive.

When the team presented the descriptions based on religion and caste stereotypes presented in the Bollywood films that were uncovered by the study to 150 school students the results were stunning!

94% of them felt that these stereotypical representations were correct and factual!

Hindus were funding their own demonization!

The Hindus have woken up to this and have decided that they will no longer fund their own demonization. The sheep refused to be devoured by the wolf anymore!

So it is preaching hate now?!!

That is precisely what Vivek Agnihotri tries to beat into Rajdeep Sardesai's hate-filled mind.

A new movie marketing manual

Sardesai further tried to link the success of "The Kashmir Files" with "patronage by BJP" - trying to slap the "propaganda movie" label onto Vivek Agnihotri's tremendous effort. How Vivek demolishes that entire argument shows two things:

Thought that went into the pre-screenings done across US and Europe prior to the movie being released in India

How Vivek Agnihotri has single-handedly authored the revolutionarily new marketing manual of Indian movies. Not just market movies in India but globally. On a shoe-string at that!

This interview is very instructive in how the Leftist propaganda in India can be demolished clearly and directly without any emotional shouting. For that lesson, watch this video.

If you like our content and value the work that we are doing, please do consider contributing to our expenses. CHOOSE THE USD EQUIVALENT AMOUNT you are comfortable with.

If you like this post - please share it with someone who will appreciate the information shared in this edition.

Today’s ONLINE PAPER: Check out today’s “The Drishtikone Daily” edition. - THE DRISHTIKONE DAILY