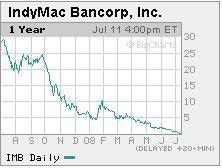

Biggest Bank failure in US! IndyMac – $20 billion – goes under..

Image via Wikipedia

Today a USD 20 billion IndyMac bank went down. Got an email from a friend who gave an account of how it affects at the personal level..

Indy Mac bank based in California was taken over by FDIC on 7/11/2008 at 3:00 PM PDT and is the largest Bank Failure ever. It is strongly suggest that you review all bank accounts and keep the limits below $100,000 for bank accounts and below $500,000 for Brokerage.

My friend’s Dad had an account with > $30,000 at Indy Mac bank and he tried to get his money out last week and they said that they could not find his signature card, and refused his withdrawal. He then asked if they could wire the funds out, and they said that he would need to submit a notarized document requesting the wire. UNBELIEVABLE!!!

His dad’s account is fully insured, but most likely he will lose 1 months of Interest since his interest would have posted on 7/15/2008 and the bank went under on 7/11/2008.

There has been a lot of news around WAMU (Washington Mutual) and Lehmann Brothers, and they are also very large and could possibly go under. It is highly advisable to reduce all accounts EVERYWHERE below the insurance limits. Especially vunerable are all business accounts, which often have balances greater than the FDIC limits.

Please feel free to forward to others that you feel could benefit from such knowledge.

So, guys keep tabs on your banker and brokers, as many of them are moving to the fly-by-night operation style. You should check out the notice posted on the bank’s website – its amazing how a $20 billion dollar instution “closes” down overnight, and is opened the following business day taken over by the FDIC!!! The FDIC anticipates that $19 Billion of the $20 billion on deposit was insured. The FDIC expects that the $1 Billion in uninsured depositors will recover approximately 50% of their “investment” above the FDIC insurance limits.

How the failure happened?

IndyMac grew rapidly during the real estate and home building boom. Its specialty was so-called Alt-A loans, those for which home buyers were asked to produce little or no evidence of income or assets other than the house they were buying.

While home prices climbed, Alt-A loans posed few problems for IndyMac. If a buyer wasn’t able to afford his payments, the bank got title to a home worth more than the amount owed. The bank was also able to find investors eager to buy pools of those mortgages that had been pulled together into securities backed by the future payments.

But when the housing bubble burst and prices began to fall, losses at IndyMac began to rise. Investors ran away from the mortgage-backed securities, leaving the bank to suffer the loan losses itself and without the funding it needed to make new, safer loans.

Technorati : Bank, Bankruptcy, IndyMac